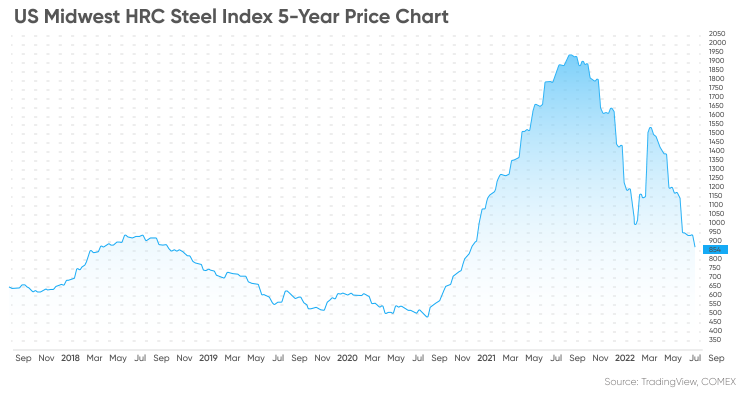

US steel prices remain in an extended downward trend as of 9 September 2022. Futures for the commodity have slid from close to $1,500 at the start of the year to trade around the $810 mark in early September – a drop of over 40% year-to-date (YTD).

The global market has weakened since late March as spiralling inflation, Covid-19 lockdowns in parts of China and the conflict between Russia and Ukraine have all heightened demand outlook uncertainty in 2022 and 2023.

The US Midwest Domestic Hot-Rolled Coil (HRC) Steel (CRU) continuous futures contract was down 43.21% since the start of the year, having last closed at $812 on 8 September.

HRC prices hit multi-month highs in mid-March, as supply concerns over steel output and exports in Russia and Ukraine supported the market.

However, market sentiment has soured since a strict lockdown was imposed in Shanghai in early April, causing prices to plunge in the subsequent weeks. The Chinese financial centre officially ended its two-month lockdown on 1 June and lifted further restrictions on 29 June.

China’s economic recovery has gained momentum in July, as confidence has improved and business activity is on the uptick, despite sporadic Covid outbreaks throughout the country.

Are you interested to learn more about steel commodity prices and their outlook? In this article, we'll look at the latest news affecting the market along with analysts’ steel price predictions.

Geopolitical instability drives steel market uncertainty

In 2021, the US HRC steel price trend was up for most of the year. It hit a record high of $1,725 on 3 September before falling in the fourth quarter.

US HRC steel prices have been volatile since the start of 2022. According to CME steel price data, the August 2022 contract started the year at $1,040 per short ton, and fell to a low of $894 on 27 January, before rebounding above $1,010 on 25 February – a day after Russia invaded Ukraine.

The price rallied to $1,635 per short ton on 10 March on concerns about disruptions to steel supply. But the market turned bearish in response to lockdowns in China, which have dampened demand from the world’s largest steel consumer.

In its Short Range Outlook (SRO) for 2022 and 2023, the World Steel Association (WSA), a leading industry body, said:

In a piece on the EU construction sector in early September, ING analyst Maurice van Sante highlighted that expectations of lower demand globally — not just in China — were putting downward pressure on the price of the metal:

Post time: Sep-14-2022