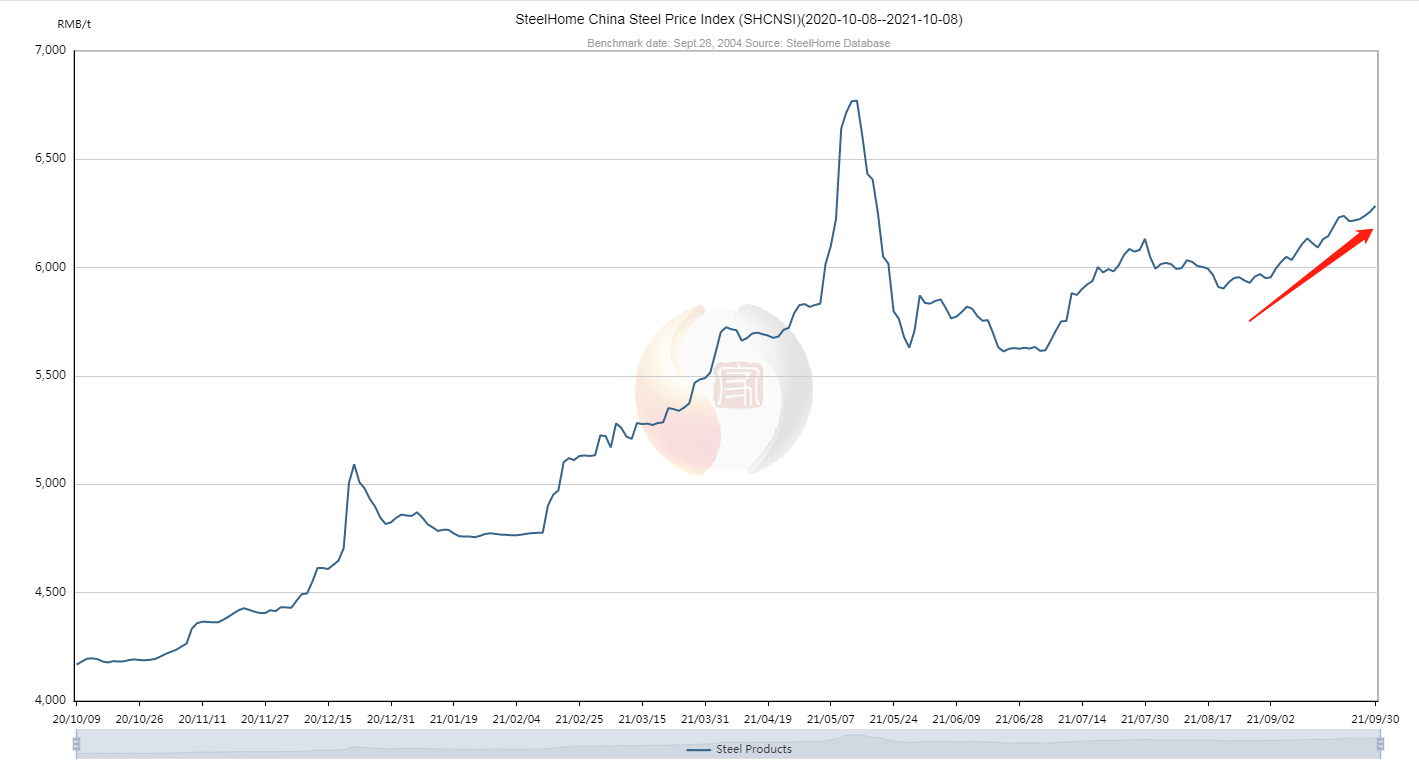

Shanghai steel futures hold the strong momentum, remaining around CNY 5,800 a tonne and getting close to a record of CNY 6198 hit earlier this year. Environmental curbs in China hit steel mills, with production falling in September and August as the top producer is attempting to reach carbon neutrality by 2060. Also, a strong rebound in demand for manufactured goods from cars and appliances to pipes and cans is putting additional pressure on prices. On the other hand, the Chinese economy is slowing down as power shortages and supply constraints weigh on factory activity while the Evergrande debt crisis raised concerns about a fall in demand from the property market as the sector accounts for over a third of steel consumption in China.

Steel Rebar is mostly traded on the Shanghai Futures Exchange and London Metal Exchange. The standard future contract is 10 tons. Steel is one of the world’s most important materials used in construction, cars and all sorts of machines and appliances. By far the biggest producer of crude steel is China, followed by European Union, Japan, United States, India, Russia and South Korea. The steel prices displayed in Trading Economics are based on over-the-counter (OTC) and contract for difference (CFD) financial instruments. Our steel prices are intended to provide you with a reference only, rather than as a basis for making trading decisions. Trading Economics does not verify any data and disclaims any obligation to do so.

Post time: Oct-08-2021